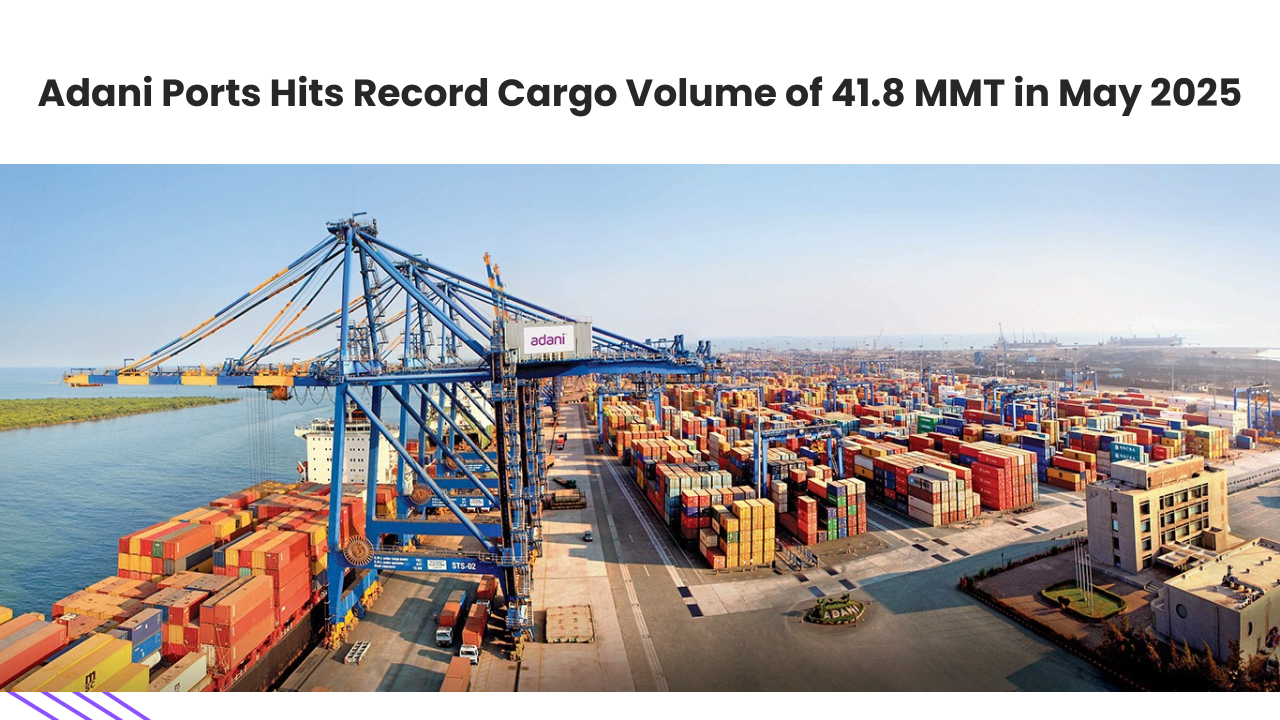

Adani Ports and Special Economic Zone Limited (APSEZ), India’s largest private port operator, has set a new benchmark by handling 41.8 million metric tonnes (MMT) of cargo in May 2025, marking a 17% year-on-year (YoY) growth. This milestone reinforces APSEZ’s dominance in India’s logistics and maritime trade sector.

1. Adani Ports Company Background: APSEZ – India’s Ports & Logistics Giant

Overview

- Parent Company: Part of the Adani Group, India’s largest infrastructure conglomerate.

- Primary Business: Port operations, logistics, and special economic zones (SEZs).

- Market Position:

| Metric | May 2025 | YoY Growth | YTD (Jan-May 2025) |

| Total Cargo | 41.8 MMT | +17% | 79.3 MMT (+10%) |

| Container Volumes | – | +22% | – (+21%) |

| Dry Cargo | – | +17% | – |

| Rail Volumes (TEUs) | 0.06 Mn | +13% | 0.12 Mn (+15%) |

| GPWIS Volumes (MMT) | 2.01 MMT | +4% | 3.8 MMT (+4%) |

- Largest private port operator in India (~24% market share).

- Key ports: Mundra (India’s largest commercial port), Krishnapatnam, Dhamra, Hazira, and Vizhinjam (under development).

Business Segments

- Port Operations – Cargo handling (containers, dry bulk, liquid cargo).

- Logistics & Rail – Integrated supply chain solutions, rail freight, and warehousing.

- SEZ & Industrial Zones – Supporting trade and manufacturing clusters.

Global Footprint

- Expanding internationally with ports in Sri Lanka (Colombo), Israel (Haifa), and Tanzania.

- Strategic acquisitions (e.g., Krishnapatnam Port, Gangavaram Port) strengthening dominance.

2. Adani Ports Operational Performance – May 2025 Highlights

Record-Breaking Cargo Volumes

Key Takeaways

- Container Boom – Driven by rising EXIM trade and Mundra’s efficiency.

- Dry Cargo Growth – Reflects strong coal, iron ore, and agricultural shipments.

- Logistics Expansion – Rail & GPWIS growth shows integrated supply chain strength.

3. Financial Performance & Key Metrics

FY2024 Financial Snapshot (Latest Annual Report)

| Parameter | FY2024 (₹ Cr) | YoY Growth |

| Revenue | ₹26,500 | +24% |

| EBITDA | ₹16,200 | +28% |

| Net Profit | ₹8,100 | +32% |

| Debt-to-Equity Ratio | 1.2x | Stable |

Adani Ports Stock Market Performance (NSE: ADANIPORTS)

- Market Cap: ~₹2.5 lakh crore (as of June 2025).

- Dividend Yield: ~1.5%.

- 1-Year Stock Return: +35% (outperforming Nifty Infrastructure Index).

Growth Drivers Behind Financial Success

- Volume Growth – Rising cargo demand from India’s expanding trade.

- Operational Efficiency – Higher margins due to automation & cost control.

- Diversification – Expansion into logistics, SEZs, and international ports.

4. Growth Strategies & Future Outlook

. Expansion Plans

- Mundra Port Expansion – Aiming to become world’s largest port by 2030.

- Vizhinjam Port (Kerala) – Deep-sea transshipment hub (to rival Colombo).

- International Acquisitions – Targeting ports in Africa & Southeast Asia.

Digital & Sustainability Initiatives

AI-driven logistics for real-time cargo tracking.

Green Ports Initiative – Solar power, LNG bunkering, and emission cuts.

Risks & Challenges

Global trade slowdown risks.

Regulatory hurdles in port acquisitions.

5. Conclusion: Why APSEZ Remains a Strong Investment Bet

Market Leader: Dominates India’s port sector with consistent growth.

- Strong Financials: High revenue, EBITDA, and profit growth.

- Future-Ready: Expanding logistics, digitalization, and green initiatives.

With record cargo volumes, solid financials, and aggressive expansion plans, APSEZ is well-positioned to capitalize on India’s rising trade demand

Did you find this article interesting?

Stay connected with our blog for more insights and updates. We’d love to hear your thoughts, questions, or feedback in the comments below!

Multibaggers of June 2024 to watch in June 2025

Maruti Suzuki Sales May 2025: Strong Export Growth and Steady Domestic Demand

Adani Ports posts record 41.8 MMT cargo in May 2025 with 17% YoY growth. Strong financials, global expansion, and logistics boost future outlook.

Adani Ports and Special Economic Zone Ltd. (APSEZ) continues to strengthen its leadership in India’s maritime and logistics sector, setting a new record with 41.8 MMT cargo handled in May 2025—a 17% YoY growth. With robust financials, expanding global presence, and a sharp focus on digitalization and sustainability, APSEZ is well-positioned to meet rising trade demands. Strategic projects like the Mundra and Vizhinjam expansions, along with strong container and dry cargo volumes, reinforce its long-term growth trajectory. As India’s trade ecosystem evolves, APSEZ remains a reliable and future-ready player, making it an attractive proposition for long-term investors.