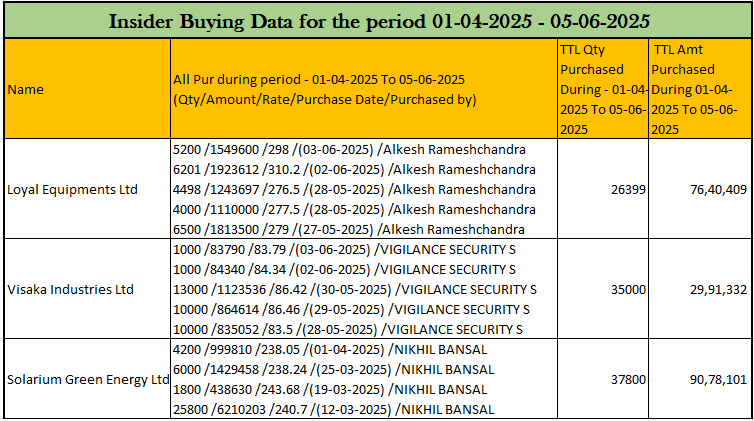

Insider Buying Activity Suggests Growing Confidence in Loyal Equipments, Visaka Industries, and Solarium Green Energy

Highlights

- Multiple companies report insider buying, suggesting bullish sentiment.

- Loyal Equipments posts strong YoY revenue and profit growth.

- Visaka Industries expands sustainable product lines despite FY25 profit dip.

- Solarium Green Energy shines post-IPO with rising revenue and robust cash reserves.

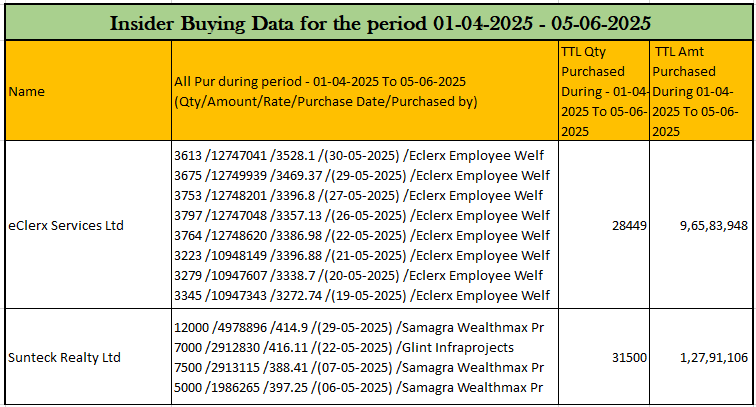

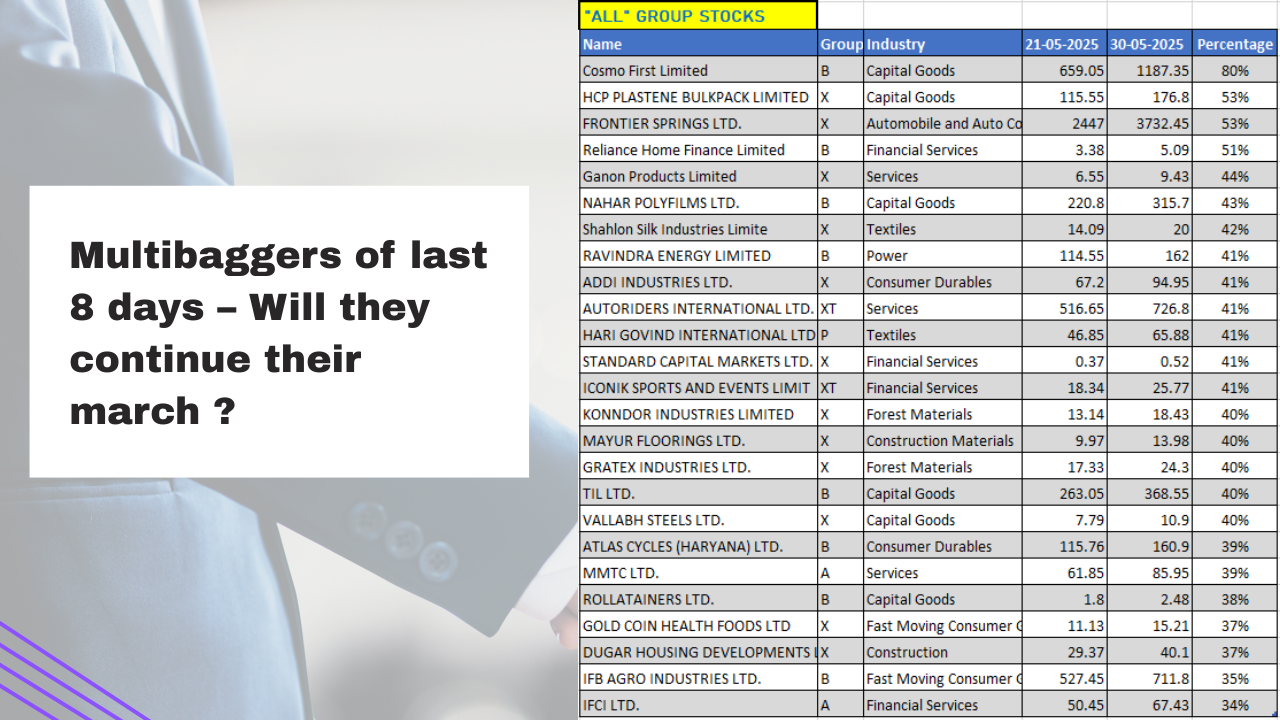

Heavy insider buying has been reported in several emerging multibagger stocks, a trend that could signal future upside potential. Insider buying—where directors, employees, or their close associates invest in company shares—often points to positive business confidence and strong fundamentals. It suggests that those with the closest insights into a company believe its stock is undervalued or poised for growth.

Here’s a closer look at three companies where insider activity has been followed by notable developments:

Loyal Equipments Ltd: Strong Growth and Solid Financials

Gujarat-based Loyal Equipments Ltd, a leading manufacturer of industrial equipment, has announced impressive financial results for FY2025.

- Revenue: ₹7571.58 lakh (up from ₹7115.13 lakh in FY24)

- Net Profit: ₹1066.20 lakh (up from ₹708.76 lakh)

- EPS: ₹8.42 (up from ₹6.95)

- Total Assets: ₹7545.38 lakh (up from ₹5392.75 lakh)

- Cash Reserves: ₹1259.69 lakh

The company showed efficient expense management and expanded its equity base significantly. A clean audit report further reinforces trust in the numbers.

With insiders investing their own funds and the company maintaining a strong balance sheet, Loyal Equipments is showcasing signs of sustainable financial growth.

Visaka Industries Ltd: Sustainability-Driven Future

Visaka Industries Ltd, based in Telangana, is a pioneer in sustainable building solutions. With 12 manufacturing units and 7,000+ dealers, the company is a major player in both Indian and global markets.

Key Product Lines:

- Vnext Boards: Durable and eco-friendly fiber cement panels.

- ATUM Solar Roofs: India’s first integrated solar roof solution.

- Wonder Yarn: Yarn made from recycled PET bottles.

Despite operational challenges in FY2025:

- Q4 Revenue: ₹426.09 crore

- Q4 Net Profit: ₹16.04 crore

- Full-Year Revenue: ₹1540.81 crore

- Net Profit (Standalone): ₹0.14 crore

- Net Loss (Consolidated): ₹3.01 crore

The company proposed a dividend of ₹0.50/share, and the AGM is set for July 30, 2025. Insiders continuing to hold or buy shares could indicate optimism about long-term prospects, especially given Visaka’s focus on green products.

Solarium Green Energy Ltd: Solar Growth Story

Founded in 2018, Solarium Green Energy Ltd has quickly become a leader in India’s solar sector. The company went public via the BSE SME platform in early 2025 and has maintained momentum ever since.

- FY2025 Revenue: ₹23,007.64 lakh (up from ₹17,739.69 lakh)

- Net Profit: ₹1658.86 lakh

- Cash Reserves: ₹7700.24 lakh

- Key Projects: ₹71.55 crore order from Ministry of Home Affairs

The company raised ₹105.04 crore from its IPO, mainly for working capital and corporate needs. It has shown transparency in fund utilization, with no deviations reported. An unmodified audit opinion and increasing insider interest reflect confidence in continued performance.

What Should Investors Watch?

Insider buying is not a guaranteed investment signal, but it is a valuable clue. When backed by solid financials—as seen with Loyal Equipments, Visaka, and Solarium—insider activity can indicate future growth potential.

For retail investors, keeping track of such moves can offer a competitive edge. However, it’s crucial to combine this with other metrics like earnings growth, business model strength, and industry trends.

Conclusion:

The recent wave of insider buying across promising companies suggests growing optimism about their future prospects. With steady revenue growth, profitability, and strong balance sheets, these companies are gaining investor attention. Used wisely, insider activity can be a useful tool in identifying potential multibagger stocks.

Did you find this article interesting?

Stay connected with our blog for more insights and updates. We’d love to hear your thoughts, questions, or feedback in the comments below!