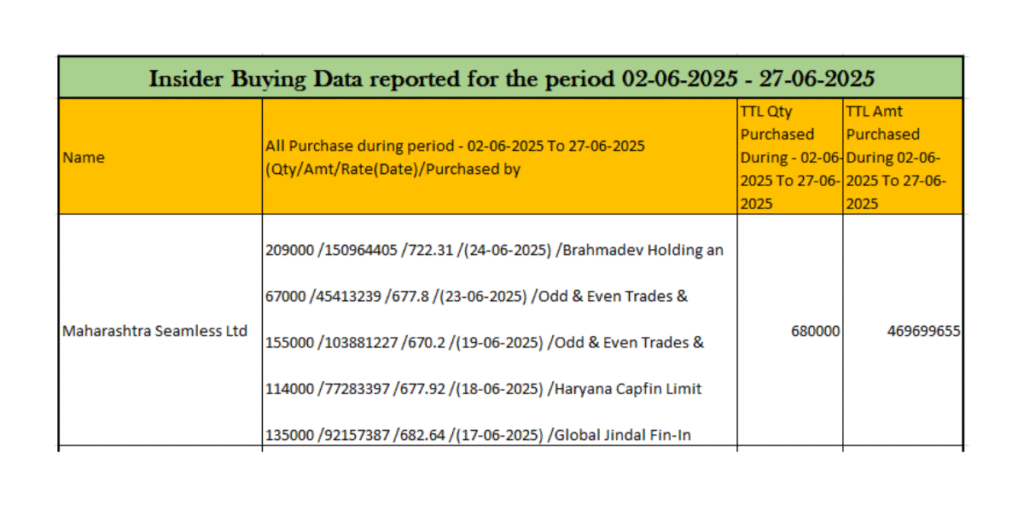

One has to closely watch insider buying activity as it indicates health of the company and future predictions can be done since insider buying which means buying of shares by companies own directors, relatives or employees gives positive signal on the company’s fundamentals.

When insiders put their own money into the company’s stock, it often reflects a belief that the shares are undervalued or that positive developments lie ahead. This can be a powerful vote of confidence, especially during periods of uncertainty.

Investors often monitor insider activity as a potential indicator, not a guaranteed signal. Used wisely, it can offer useful insight into how those closest to a company view its future—and possibly hint at upcoming growth before the broader market catches on.

Maharashtra Seamless Ltd: Forging India’s Energy and Infrastructure Backbone

Founded in 1988, Maharashtra Seamless Ltd (MSL) is a flagship of the Jindal Group and a leading manufacturer of seamless and ERW steel pipes and tubes, crucial for oil, gas, power, and infrastructure sectors. The company’s integrated Raigad facility enables it to manage the entire production chain—from raw steel to finished pipes—maintaining quality and cost competitiveness .

In FY 2022-23, MSL reported approx. ₹2,000 cr in revenue with ~₹200 cr net profit, reflecting ~11 % YoY revenue growth and a ~10 % profit margin. Its core sales—seamless pipes and tubes—account for 70 % of revenue, with specialty and other steel products adding depth to its portfolio. Export markets (US, Europe, Middle East) contributed around ₹600 cr, highlighting its global footprint .

Recent quarters spotlight growth: Q3 FY24 saw net income jump ~61 % YoY, driven by higher operating income and disciplined cost control .In Q4 FY25, revenue rose 16.5 % YoY and net profit was up 9 % YoY (~₹243 cr), prompting a 5 % stock rally .

Investor sentiment is upbeat. A Reddit poster notes its strong fundamentals, low P/E (~<10), healthy ROCE (~16-17 %) and significant upside potential:

Maharashtra Seamless LTD stands on a robust industrial moat—integrated operations, policy support, rising energy infrastructure demand, and diversification into renewables. With solid financials and long-term tailwinds, it makes a compelling case for long-term portfolios.