One has to closely watch insider buying activity as it indicates health of the company and future predictions can be done since insider buying which means buying of shares by companies own directors, relatives or employees gives positive signal on the company’s fundamentals.

When insiders put their own money into the company’s stock, it often reflects a belief that the shares are undervalued or that positive developments lie ahead. This can be a powerful vote of confidence, especially during periods of uncertainty.

Investors often monitor insider activity as a potential indicator, not a guaranteed signal. Used wisely, it can offer useful insight into how those closest to a company view its future—and possibly hint at upcoming growth before the broader market catches on.

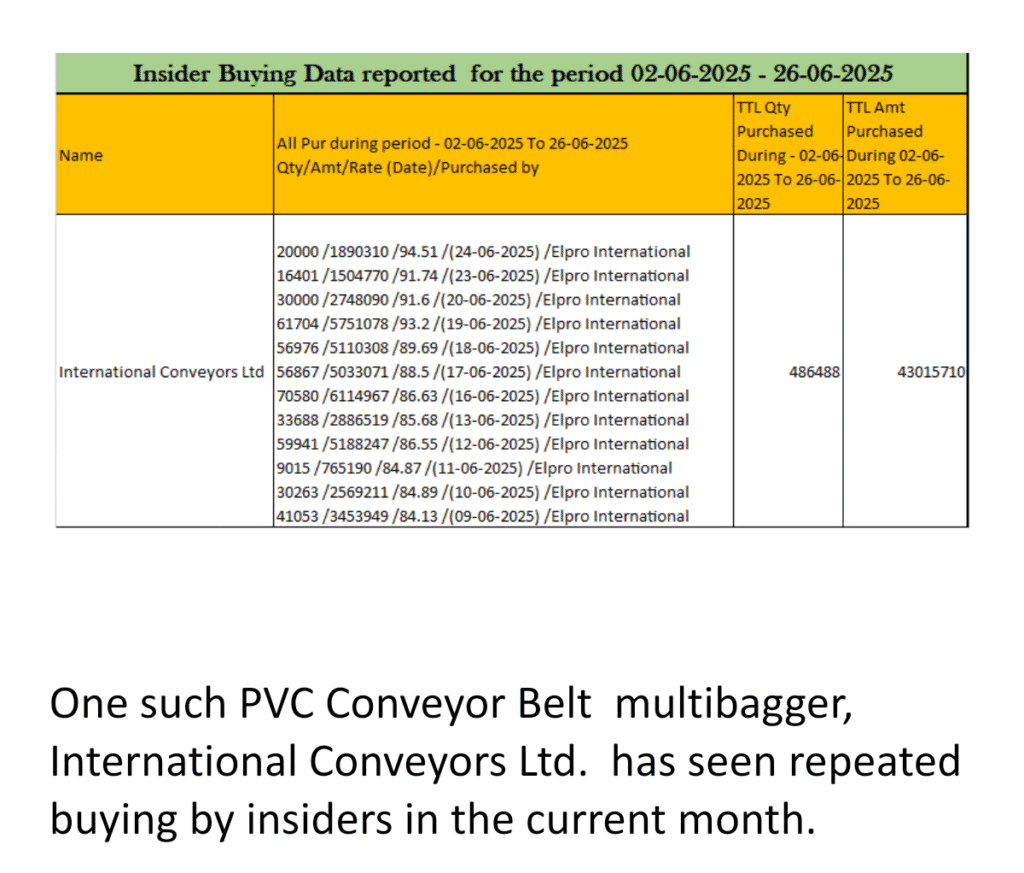

International Conveyors Ltd: Riding the Growth Wave in Belt Manufacturing

Established in 1973 and headquartered in Aurangabad, International Conveyors Ltd (ICL) has grown into the world’s second-largest manufacturer of PVC conveyor belts. Over 90% of its output is exported to regions like North America, Australia, and South Africa, serving major industrial players in mining, cement, and steel sectors including Shree Cement and Tata Steel

Financially, ICL has been on a strong upward trajectory. In the March 2025 quarter, revenue surged 110% year-over-year to ₹54.6 cr, while net profit more than doubled to ₹13.03 cr—up 115% from the previous factor. Full-year results echoed this trend with a 47% rise in profit to ₹91.7 cr and a 13% increase in sales to ₹151.9 cr .

Such performance hasn’t gone unnoticed by the market. The past three months saw ICL stock climb ~28%, with the 52-week range between ₹62 and ₹110.5—currently trading near ₹86 with a P/E ratio under 6. Promoter confidence is bolstered by recent insider buying (~0.15% stake added in June 2025), coinciding with a 15% stock rally.

Strategically, ICL is diversifying beyond belts. It holds equity in renewable energy (Sterling & Wilson) and has infused funds into JSW One Platforms, signaling a broader growth mindset.

With robust export presence, strong profitability, attractive valuation, and strategic investments, International Conveyors stands poised to carry forward its momentum in global industrial markets.

Did you find this article interesting?

Stay connected with our blog for more insights and updates. We’d love to hear your thoughts, questions, or feedback in the comments below!

Insider Buying Activity Surges in Silver Touch Technologies: A Bullish Signal for Investors?

Heavy Insider Buying Spotted in These Multibagger Stocks: What It Means for Investors

Repeated Insider Buying in Star Health: What Does It Indicate for Investors?