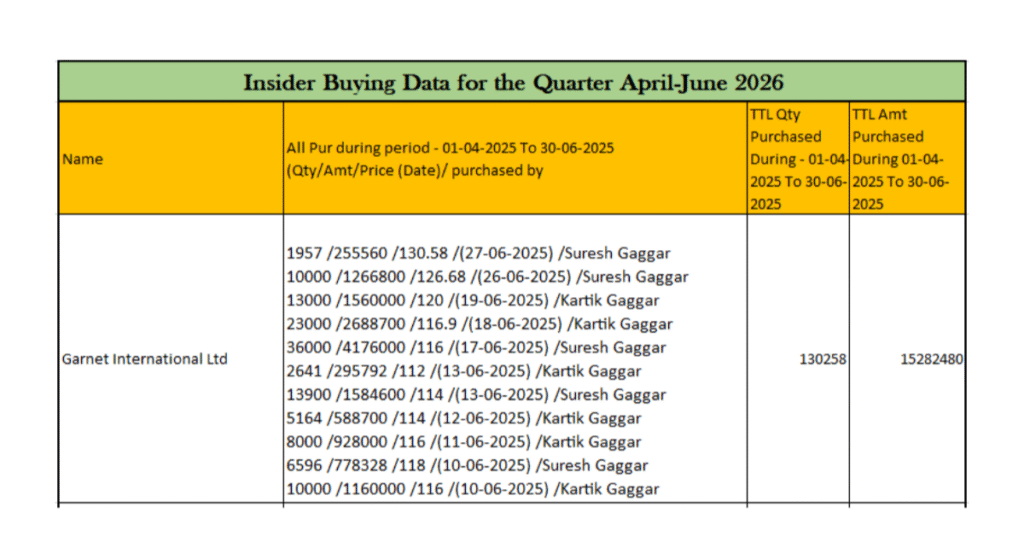

One has to closely watch insider buying activity as it indicates health of the company and future predictions can be done since insider buying which means buying of shares by companies own directors, relatives or employees gives positive signal on the company’s fundamentals.

When insiders put their own money into the company’s stock, it often reflects a belief that the shares are undervalued or that positive developments lie ahead. This can be a powerful vote of confidence, especially during periods of uncertainty.

Investors often monitor insider activity as a potential indicator, not a guaranteed signal. Used wisely, it can offer useful insight into how those closest to a company view its future—and possibly hint at upcoming growth before the broader market catches on.

Garnet International Ltd., headquartered in Mumbai since 1981, operates across two distinct verticals: financial investments and textiles. Its investment arm is built on a disciplined, process-driven philosophy that focuses on identifying niche, small- and mid-cap firms with strong management teams and growth potential. Over the years, Garnet has partnered with sector leaders in IT services, infrastructure, logistics, chemicals, pharma-grade biotech, solar energy, and more, aiming for long-term value creation.

On the textile side, the Sukartik Clothing business in Ludhiana manufactures seamless and knitted garments for both domestic and export markets.

The company is publicly listed on the BSE (ISIN INE590B01010) and reported a June-2024 quarter net profit surge of 413%, rising from ₹0.15 crore to ₹0.77 crore, even as revenues dipped amid market conditions. As of June 25, 2025, its share price stood at ₹123.05—up over 100% year-on-year—with a market cap of approximately ₹242 crore. Management comprises seasoned professionals such as founders Suresh and Ramakant Gaggar, along with a diverse board bringing expertise in compliance, pharma, and textiles.

In December 2024, Garnet secured ₹88.4 million via a private placement to fuel further expansion. Earlier, in March 2024, it acquired an 81% stake in Whitewall India Pvt Ltd, a strategic move to broaden its portfolio. With a clear vision to become India’s investment partner of choice, Garnet leverages its dual-sector expertise and disciplined capital deployment strategy for sustainable growth and value creation.