Insider buying refers to the purchase of a company’s shares by its top executives, directors, or major stakeholders—individuals who possess in-depth knowledge about the company’s financial health and future prospects. These transactions are publicly disclosed, making them a valuable resource for retail investors.

When insiders buy shares using their own funds, it often signals strong confidence in the company’s future performance. Unlike public investors, insiders have access to strategic insights, such as upcoming contracts, cost-cutting measures, or new product launches. Their investment decisions can serve as a leading indicator for potential upward trends in the stock’s price.

Clusters of insider buying—especially from multiple executives—are considered even more bullish. It reflects a consensus among key decision-makers that the company is undervalued or poised for growth. Historically, such patterns have preceded stock rallies or long-term value creation.

However, it’s important to analyze the context—such as the size and frequency of purchases—and combine this information with broader fundamental analysis. While insider buying doesn’t guarantee gains, it can offer a useful clue in identifying undervalued stocks and potential trend reversals.

For smart investors, tracking insider activity can be a strategic tool to anticipate market movements before they become mainstream.

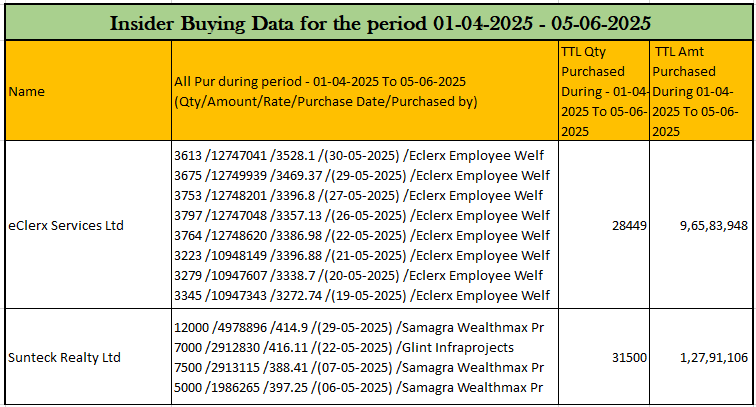

eClerx Services Ltd – Insider buying

Established in 2000 and headquartered in Mumbai, is a leading global provider of business process management, automation, and data analytics services. With a workforce exceeding 17,000 professionals, the company operates across multiple countries, including India, the USA, the UK, Singapore, and Italy.

Serving a diverse clientele that encompasses Fortune 2000 enterprises, eClerx specializes in delivering tailored solutions across various sectors such as financial services, telecommunications, retail, fashion, media & entertainment, manufacturing, travel & leisure, and technology. The company’s core divisions—eClerx Customer Operations, eClerx Digital, and eClerx Markets—focus on enhancing customer experiences, driving digital innovation, and optimizing capital market operations, respectively.

eClerx’s commitment to innovation is evident through its proprietary platforms like GenAI360 and Market360, which leverage artificial intelligence and advanced analytics to deliver actionable insights and drive business efficiency . The company’s emphasis on sustainability and excellence has earned it accolades such as the Golden Peacock National Quality Award and recognition from EcoVadis for its sustainability practices.

Publicly traded on the NSE and BSE under the ticker ECLERX, the company reported a revenue of ₹33.66 billion and a net income of ₹5.41 billion for the fiscal year ending March 2025 . eClerx continues to be a trusted partner for organizations seeking to harness technology and domain expertise to drive transformative business outcomes

Sunteck Realty Limited,-Insider buying

Headquartered in Mumbai, is a prominent real estate developer specializing in luxury and ultra-luxury residential and commercial projects. Founded in 2000 by Kamal Khetan, the company has established a significant presence in the Mumbai Metropolitan Region (MMR), boasting a development portfolio of approximately 52.5 million square feet across 32 projects.

Sunteck’s flagship developments include Signature Island, Signia Isles, and Signia Pearl in Bandra Kurla Complex (BKC), attracting high-profile residents and setting benchmarks in luxury living . Other notable projects encompass SunteckCity in Goregaon, Sunteck Beach Residences in Vasai, and Sunteck WestWorld in Naigaon.

In the fiscal year ending March 2025, Sunteck Realty reported its highest-ever annual pre-sales of ₹2,531 crore, marking a 32% increase over the previous year. The company’s revenue surged by 51% to ₹853 crore, and net profit more than doubled to ₹150 crore from ₹71 crore in FY24.

Sunteck Realty’s commitment to innovation, quality, and customer-centricity has solidified its reputation as a trusted name in the real estate sector. With a focus on city-centric developments and a strong financial foundation, the company continues to shape Mumbai’s skyline with its premium offerings

Did you find this article interesting?

Stay connected with our blog for more insights and updates. We’d love to hear your thoughts, questions, or feedback in the comments below!